In recent years digitalisation in nearly all areas of life has resulted in exponential growth in the sectors of artificial intelligence (AI) and cyber security. Global investment by companies in AI increased sevenfold between 2015 and 2022, and a compound annual growth rate (CAGR) is forecast for the future of 28 percent for AI (by 2030) and 11 percent (by 2028) for cyber security.

Furthermore, both fields are increasing intertwined because AI-based technologies play a crucial role in deterring cyber threats. According to one survey, 7 out of 10 companies in Germany use AI for cyber deterrence.

These dynamics have triggered a wave of mergers and acquisitions (M&A) because companies are looking for strategic alliances to strengthen their position in these critical markets. The following examples of such strategic alliances can be considered pioneering transactions carried out by leading companies in the industry:

- Google and Mandiant: in 2022 Google acquired the cyber security firm Mandiant for 5.4 billion US dollars. This acquisition strengthened Google’s cloud security and expanded is capabilities to identify and deter threats. Mandiant brought with it an abundance of cyber security intelligence and an experienced team of experts, which Google was able to integrate into its existing security services.

- Microsoft and RiskIQ: in the same year, Microsoft acquired RiskIQ, a company specialising in threat intelligence and attack detection. This acquisition allowed Microsoft to improve its security products and offer more comprehensive end-to-end security solutions.

- Palo Alto Networks and Demisto: another remarkable example is the takeover of Demisto by Palo Alto Networks in 2019. Demisto was leading in the area of security orchestration, automation and response (SOAR), and the acquisition for 560 million US dollars allowed Palo Alto Networks to expand its automated capabilities to react to cyber threats.

Drivers for M&A activities

Technological synergies: companies look for ways to expand and integrate their technological capabilities. AI can considerably increase the efficiency and effectiveness of cyber security solutions by detecting and responding to threats in real time. Mergers and acquisitions enable companies to combine advanced AI algorithms and cyber security solutions so as to be able to offer more comprehensive and robust products.

Market access and expansion: With M&A, companies can tap into new markets and expand their geographic presence. Particularly in the cyber security sector, which is strongly characterised by regional regulation and compliance requirements, acquisitions offer a quick way to get access to new markets and overcome regulatory hurdles.

Talent acquisition: the shortage of skilled workers in the areas of AI and cyber security are a further important driver for M&A deals. Acquisitions allow companies to gain not only technological resources but also valuable talent and expertise that are often hard to find on the open market.

Important M&A deals

These drivers are also behind recent deals:

Bechtle and Planet AI: in October 2023 Bechtle acquired 51 percent of the AI company Planet AI. The company was founded in 2015 and focuses on digital document analysis and process automation. With its majority share, Bechtle plans to become Europe’s leading IT systems company.

Vectra AI and Siriux Security Technologies: at the start of 2022, Vectra AI acquired the identity and SaaS threat management provider Siriux Security Technologies. Vectra will use Siriux’s technologies to support its customers in configuring and detecting threats in cloud identity and SaaS applications.

These deals underline the trend of using AI for cyber security purposes and achieving this by way of acquisitions. But the KI and cyber security field is not only attractive to strategists – the world of investors is interested as well.

Thomas Bravo and Darktrace: the US investment company acquired the cyber security provider Darktrace for 5.3 billion US dollars, a company which uses AI to detect and react to cyber threats.

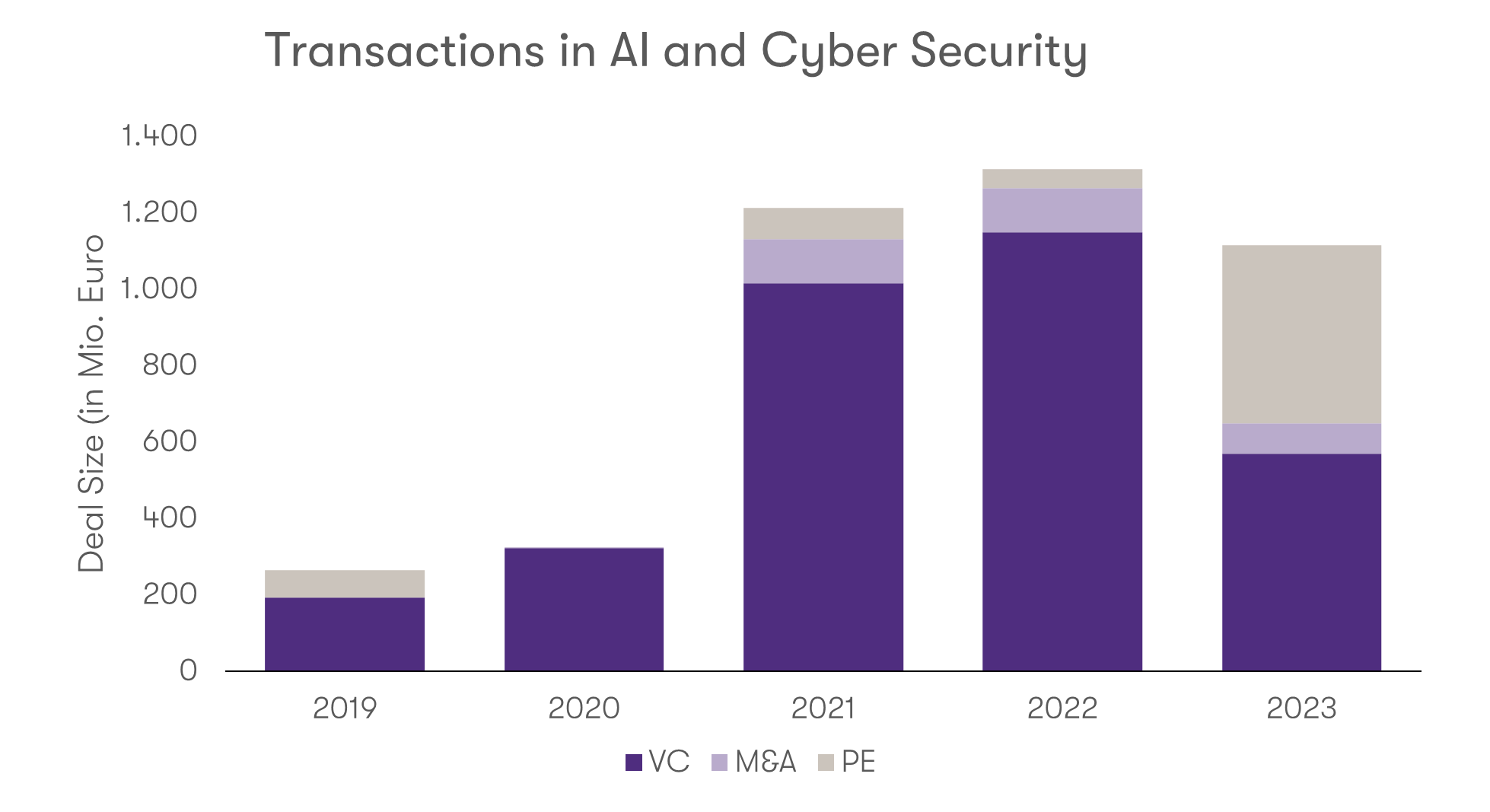

The growth of private equity investments and the general rapid rise in the value of AI and cyber security on the M&A market are impressive:

Source: Pitchbook

Future outlook

It is expected that M&A activities in AI and cyber security will continue to increase. In view of the growing complexity and frequency of cyber-attacks and the continuous further development of AI technologies, companies continue to look for strategic partnerships in order to strengthen their security infrastructure and develop innovative solutions.

The integration of AI into cyber security solutions still has a long way to go. Future acquisitions might concentrate on specialist AI firms that specialise in specific aspects such as machine learning, predictive analytics or natural language processing. Cyber security companies concentrating on upcoming threats such as quantum computing or the internet of things (IoT) might also be attractive targets for acquisition.

To sum up: synergies between AI and cyber security offer added value

Merging the areas of artificial intelligence and cyber security by way of M&As is a strategic imperative for companies that want to be successful in a digital landscape that is increasingly interlinked and under threat. The synergies that come about through such deals offer both technological and economic value and contribute to the development of more robust and effective security solutions. In a world in which cyber threats are constantly growing, the integration of AI into cyber security remains a key to securing our digital future.