What are the German anti-hybrid rules ?

Due to varying local tax law, cross-border service relationships and companies involved in them can be subject to differing tax treatment in the various countries. These, so-called mismatches, can result in certain tax advantages, which can basically be broken down into two categories:

- Deduction/non-inclusion mismatches (D-NI mismatch)

A payment in Germany generates a deduction of operational expenses, while for the creditor, the payment results either in tax-exempt income or in income that is taxed at a lower tax rate due to a mismatch. - Double deduction mismatch (DD mismatch)

Operational expenses that are deductible in Germany are claimed twice, as they simultaneously reduce the tax burden another country.

Source: Grant Thornton Germany

Source: Grant Thornton Germany

In both cases, operational expenses that reduce tax create tax advantages abroad at the expense of Germany’s tax revenue. To prevent this, Section 4k EStG was introduced, imposing restrictions on the deduction of operational expenses for D-NI and DD mismatches in Germany.

Section 4k EStG is highly complex and raises numerous legal questions. On 13 July 2023, the Federal Ministry of Finance (BMF) published a draft circular on the application of Section 4k EStG (hereafter referred to as the “Draft Circular”), which faced significant criticism. On 5 December 2024, the BMF published its long-awaited final circular (hereafter referred to as the “Final Circular”).

Important clarifications for hybrid mismatches

As the BMF correctly notes, Section 4k EStG is particularly relevant for German companies with US shareholders (hereafter referred to as “US inbound structures”). The reason is that US tax law provides a so-called “check-the-box election”, which allows companies either to be treated for income tax purposes as non-existent or as partnerships (disregarded or flow-through entities). As the US tax treatment is not recognized for German tax purposes, checking-the-box often results in differing treatment of the relevant company under US and German tax law.

Such hybrid entities are a typical primary application case for Section 4k EStG. In particular, the Final Circular contains important rules and clarifications for such structures.

1. Hybrid financial instruments

Section 4k EStG applies to hybrid financial instruments if the corresponding income is subject to no or low taxation abroad due to a mismatch in classification or allocation of such income.

If, due to such a mismatch, income abroad is taxed at a lower rate than it would be if it were classified or allocated under German tax law, the Final Circular proportionately limits the deduction of expenses. To determine the proportionate restriction on deduction, the relationship between the actual taxation of the income abroad and hypothetical taxation on classification or allocation under German tax law is applied. The Final Circular illustrates how this is calculated with an example.

However, the circular does not include simplified calculation methods for cases involving a progressive tax scale. Additionally, there is no limitation to the amount of foreign tax actually saved as a result of applying differing tax rates.

2. Escape: Actual taxation abroad

Section 4k EStG includes certain exemptions that allow expenses to remain deductible if specific income is (actually) taxed abroad. In this context, it was disputed whether income only included under controlled foreign corporation rules (hereafter referred to as the “CFC-Rules”), rather than being subject to “regular” income tax, should still be considered as taxed abroad. The Final Circular has now clarified this: income included under CFC-Rules in the context of hybrid financial instruments is treated as equivalent to actual taxation. This principle should generally apply to other exemptions governed by Section 4k EStG.

However, the BMF has also made an exception to this principle:–income is not considered as actually taxed if it is included only under a “blending” regime. These kinds of regimes consolidate income, losses and taxes of several or all the controlled companies, which allows them to be offset across borders and legal entities. In our view, this should particularly affect the treatment of Global Intangible Low-Taxed Income (GILTI) in the context of the US CFC-Rules. Nonetheless, there has been no definitive statement on whether global minimum taxation is to be classified as actual taxation.

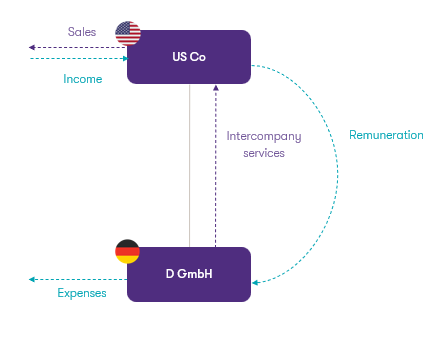

3. (No) excess taxation of intercompany service relationships

in the context of intercompany services, a literal application of Section 4k EStG can result in a considerable and unjustified tax burden. This is particularly relevant in cases where a German corporation provides intercompany services to its US parent company while being treated as disregarded entity for US tax purposes (i.e., being tax transparent) due to check-the-box election.

In such cases, the tax transparency of the German company may result in the double utilization of expenses in German and the US. In such cases, the deduction of the relevant expenses is generally restricted in Germany. However, the expenses remain deductible if and to the extent the German corporations has income that is subject to taxation in Germany and the US (hereafter referred to as the “Dual-Income-Inclusion-Escape”).

In cases where a German corporation is treated as a disregarded entity, its income is generally included in the income of its US shareholder, resulting in double taxation of such income in both the US and Germany for purposes of the Dual-Income-Inclusion Escape. However, this does not apply to income derived from intercompany services provided by a disregarded entity, as such income is not recognized for US tax purposes.

As a result, the Dual-Income-Inclusion Escape would not be applicable in such cases. This would effectively lead to the taxation of the fees received from the US parent company for intercompany services at the level of the German corporation, as the German corporation would not be permitted to deduct its operational expenses (e.g., staff costs, office expenses, etc.) under Section 4k EStG to reduce its taxable income, resulting in an inequitable tax burden.

Source: Grant Thornton Germany

The Final Circular appears to address these issues and, to avoid this excessive tax burden, stipulates that such intercompany income is to be considered “as a rule” for “reasons of equity” under the Dual-Income-Inclusion Rule. This effectively means that Section 4k EStG will not apply in these cases.

This clarification is a welcome development. However, it remains unclear under what conditions deviations from the “as a rule” application of this equity principle might occur. Additionally, taxpayers are still required to submit evidence and supporting documentation to substantiate the exclusion of Section 4k EStG.

4. (No) double deduction of losses as part of CFC-Rules

The German legislature has clarified during the legislative process that Section 4k EStG should not apply in cases where the expenses of a German taxpayer are deducted twice solely because such expenses are considered under foreign CFC rule.

Source: Grant Thornton Germany

In its Draft Circular, the BMF took an opposing view, which caused significant uncertainty in practice. Fortunately, the BMF has aligned with the legislature's perspective in the Final Circular. According to this clarification, Section 4k EStG does not apply if German losses are only considered under foreign CFC-Rules. This principle also extends to CFC regimes where income, losses, and taxes of multiple or all controlled companies are consolidated (so-called “blending”). In our view, expenses of a German corporation that are only taken into account for US GILTI taxation should therefore not fall under Section 4k EStG.

This clarification is highly welcome, as it ensures that US-controlled German entities are not automatically and broadly subjected to Section 4k EStG, which would have otherwise been the case.

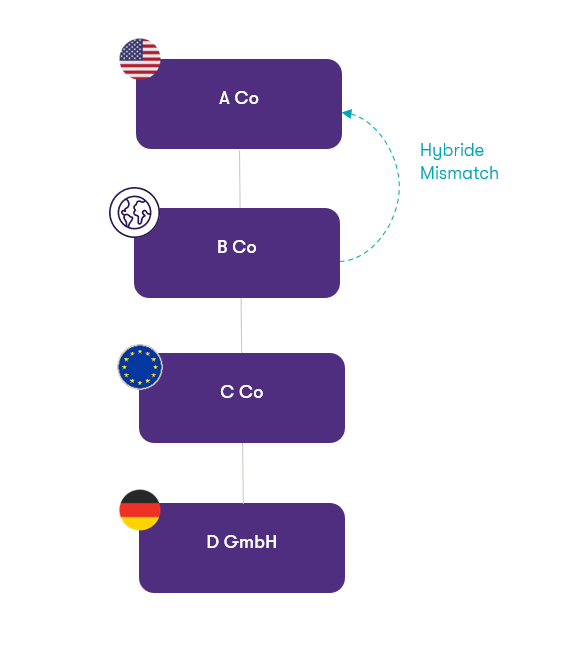

5. (Ineffective) EU Gatekeeper Rule

In general, Section 4k EStG may apply even if the German taxpayer is not directly involved in a hybrid mismatch but the mismatch occurs exclusively between its direct or indirect shareholders (so-called imported mismatches).

The German taxpayer is typically required to identify and document any such imported mismatches. Depending on the complexity of the shareholder structure, conducting such an analysis can be highly time-consuming and often impractical.

Since Section 4k EStG is based on the EU Anti-Tax Avoidance Directive (ATAD), EU member states have implemented anti-hybrid legislation similar to Section 4k EStG. According to the BMF, German taxpayers with a parent company in the EU can generally expect that any imported mismatches will already be resolved in the EU member state of the parent company. As a result, Section 4k EStG would no longer apply at the level of the German taxpayer.

Source: Grant Thornton Germany

This EU Gatekeeper Rule is, in principle, a very welcome development, as it aims to reduce the documentation and verification obligations for German taxpayers.

However, the practical scope of this rule is unfortunately restricted in the Final Circular, as it applies only to the extent that the scopes of Section 4k EStG and the anti-hybrid rules under ATAD overlap. Since Section 4k EStG exceeds the minimum requirements of ATAD, German taxpayers with EU parent companies remain obligated to identify and document the existence of any imported mismatches.

Summary: important clarifications for practice, but issues remain open

The Final Circular on Section 4k EStG brings important clarifications and simplifications, particularly for practical issues related to hybrid mismatches and US inbound structures.

However, it remains ambiguous on several important points.

The BMF has not provided sufficient details on the duties to identify and document hybrid mismatches, nor has it introduced significant procedural or documentation simplifications for US inbound cases. As a result, the requirements for evidence and supporting documentation remain high, and taxpayers continue to face complex verification obligations. Overall, however, the Final Circular provides a helpful basis for the practical application of Section 4k EStG, although some areas still leave room for interpretation.

We would be glad to assist with any questions you have about Section 4k EStG and the Final Circular. We look forward to hearing from you!

This article was written by our experts Lukas Kawka and Julia Marie Koch.