-

Operational excellence and restructuring

Advisory for businesses, whatever situation they’re in

-

Deal Advisory

We’ll advise you on national and international transactions

-

Valuation & economic and dispute advisory

We’ll value your business fairly and realistically

-

Tax for businesses

Because your business – national or international – deserves better tax advice.

-

Business Process Solutions

Measuring and utilising company data

-

Tax for financial institutions

Financial services tax – for banks, asset managers and insurance companies

-

Tax in the public sector

Advisory and services for the public sector and non-profit organisations

-

Employment law

Representation for businesses

-

Commercial & distribution

Making purchasing and distribution legally water-tight.

-

Financial Services | Legal

Your Growth, Our Commitment.

-

Business legal

Doing business successfully by optimally structuring companies

-

Real estate law

We cover everything on the real estate sector, the hotel industry, and the law governing construction and architects, condominium ownership, and letting and renting.

-

IT, IP and data protection

IT security and digital innovations

-

Mergers & acquisitions (M&A)

Your one-stop service provider focusing on M&A transactions

-

Sustainability strategy

Laying the cornerstone for sustainability.

-

Sustainability management

Managing the change to sustainability.

-

Legal aspects of sustainability

Legal aspects of sustainability

-

Sustainability reporting

Communicating sustainability performance and ensuring compliance.

-

Sustainable finance

Integrating sustainability into investment decisions.

-

Grant Thornton B2B ESG-Study

Grant Thornton B2B ESG-Study

-

International business

Our country expertise

-

Entering the German market

Your reliable partners.

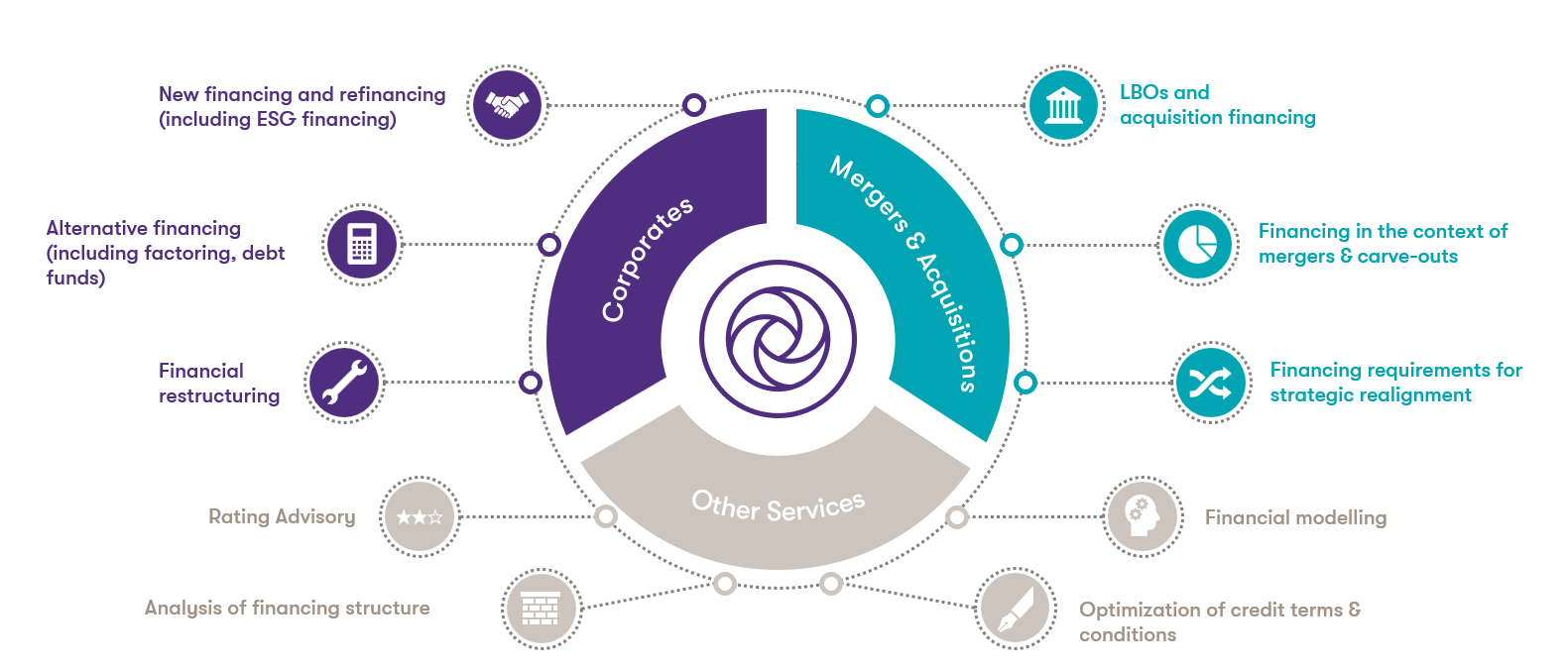

We advise mid-market companies and financial investors

The world of debt financing is becoming ever more complex and challenging. We navigate our clients safely through the financing process.

Our financing know-how gives you a crucial advantage in negotiations when looking for new financing options or renegotiating existing loans.

Our debt advisory team is made up of financing specialists who have many years of experience. We check your credit rating, analyse existing capital structures, point out potential for optimisation and provide independent advice on structuring, negotiations and implementing tailor-made solutions for financing at conditions that match your credit rating and the market and that are coordinated with your business strategy and risk appetite.

We take the time to understand your business, your strategic plans and financing needs.

When you talk about financing, we think about consulting.

We focus on supporting you with managing complex financing issues. We create financial clarity and stability with tailor-made solutions.

- Executing (re)financing processes (syndicated loans, leveraged buy-outs, KfW loans, factoring, etc.) by implementing and managing a competitive bidding process between lenders (creating requests for proposal and info memos)

- Assistance and advice with term sheets and loan negotiations

- Securing financing conditions that match the market and your credit rating

- Ensuring an optimised and cost-efficient documentation process (incl. selection)

- Grant Thornton debt advisory possesses a BaFin-licenced rating tool, which many credit institutions use themselves.

- This gives us the way to calculate an indicative rating for your company and determine your creditworthiness.

- It is also possible to point out potential for optimisation and simulate the effects of this on the rating and to assist with implementation.

- Generating integrated financial models and simulation of various capital structures

- Acting as a sounding board for companies in loan negotiations (incl. amendments and waivers)

- Compilation of bank reports

- Compilation of loan manuals (incl. conditions, reporting requirements, baskets, schedule)

ESG financing

Why use a debt advisor?

By using our extensive network of financial sponsors and carrying out the financing process in an optimised, professional way, we maximise the security of financing.

We have an experienced team with many years of expertise in financing and guarantee that the process will be carried out professionally.

By carrying out a competitive bidding process, we achieve the best conditions available on the market (e.g. for prices and covenants).

Frequently asked questions about debt advisory

Debt advisory refers to advisory services that support companies with structuring and securing capital. The goal is to find the best financing option or most sustainable financing strategy, to optimise funding, minimise risks and achieve financial goals.

Advisory also includes assistance with financial restructuring when times are more difficult for the company.

Debt advisory can include a variety of services, including:

a) Structuring of financing – advice on structuring existing financing

b) Negotiating loan terms – support with negotiating loans or bonds with banks or other financial institutions

c) Financial reorganisation – support with restructuring or a crisis: negotiating requested or necessary modifications to agreements, e.g. in the event of a breach of contract

d) Advice on alternative sources of funding – recommendations on alternative financing options, such as factoring, asset-backed securities and other forms of financing

e) Investment and growth finance, including for inorganic growth (acquisitions)

f) Rating advisory – the focus here is on advisory surrounding the company’s credit rating/creditworthiness. Advisory may focus on support with an initial external rating or on giving advice for and internal rating by a financing partner. This is a matter of reviewing the existing rating and pointing out potential to optimise or improve creditworthiness and interest conditions. Grant Thornton debt advisory possesses a BaFin-licenced rating tool, which many credit institutions use themselves.

Every company that has financing needs. We advise typical companies, family-run companies, listed companies, private equity, family offices and businesses undergoing restructuring.

Our experienced debt advisory team is made up of financing experts, who will give you independent, specific and value-creating advice on every financing project. This allows you to profit from a professionally conducted and structured financing process and, if necessary, take a considerable load off your internal resources.

By conducting a competitive bidding process, we also achieve the best conditions on the market in terms of pricing and other key contract components. This allows you to profit from our many years of expertise with negotiations and from our extensive network, which maximises the likelihood of the success/financing security of your project.

Our team is made up of experts with many years of experience and extensive knowledge of local debt markets and sectors, so that our advisory covers all types of financing instruments and capital financing.

We typically advise companies, private equity companies and family offices on refinancing, LBOs, and acquisition financing, factoring and leasing, amending loan agreements and conditions as well as everything to do with ratings (rating advisory).

Our advice is independent and in the client’s interests. Our goal is to structure and implement a long-term and viable financing strategy for our clients that fully takes into account the issues involved in the business strategy and budgeting. To do this we call on our large, international network to find the best fitting financing partner and options for you.

As experienced debt advisors, in our projects we always act in a customer-driven way and adapt the scope of our service in every project to our customers’ individual concerns.

We can assist with all aspects of financing projects or individual ones during the course of a project as required. We often act for our clients in the background as a sounding board for individual issues that come up in a financing process or for general financing issues.

Everything we do is individually agreed with the customer before the start of the project and can be modified during consultation at any time. This is how we guarantee our customers maximum flexibility at all times.

By organising a competitive bidding process, we ensure you will get the best conditions available on the market – for both pricing and the other main components of the agreement. Alongside the cost savings, we particularly focus on drafting agreements that are economically beneficial. This is how we ensure that you have enough room to manoeuvre over the long term and are set for the future.